Our 24-year old bungalow house has weathered numerous typhoons and some unintended distractions (house repairs by neighbors) over the years. Repairs here and there made it livable up to this time. We have plans to build a more sustainable home, comfortable enough for a family of four and a pet dog in the future, but a good kind of problem is holding us back. Our children’s education is always a priority, so any amount left after paying the monthly bills goes to the college fund.

In 2019, we were left with one student to support and were discussing the possibility of saving up for our permanent home structure until Covid19 happens. We were so excited about the idea that finally, we can start building our financial plan using a mortgage calculator to help us plot the expenses once we get our (future) Pag-Ibig housing loan approved. As for the loan payment, we plan to use Pag-ibig’s housing loan affordability calculator. Sadly, all that loan and mortgage discussions are set aside for the meantime.

Work from Home

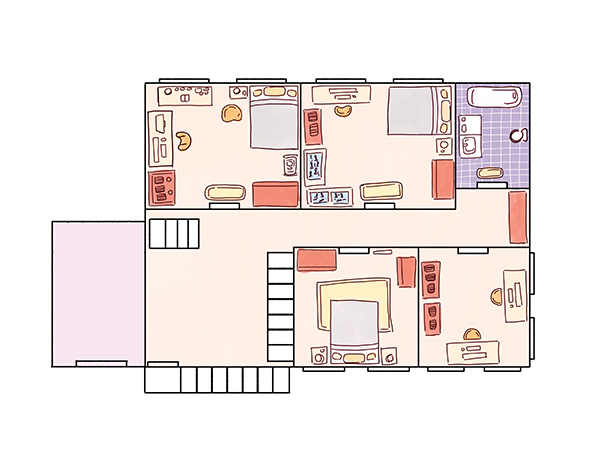

We don’t know for sure how long this pandemic will force most people to work from home. In our case, our graphic designer daughter works from home since last year. With the future house plan, the lady will have ample space to accommodate all her gadgets and design equipment. Even if she transitions back to the office, the room will remain as her working area at home. Our son, who is still studying, also needs extra space in his bedroom to do his school work.

The good thing about working from home is that our daughter was able to save her paycheck. We also keep the allowance intended for our son. He is attending online classes so, we don’t worry about transportation and meal allowances.

Effect of Pandemic in Real Estate

Covid19 has disrupted the construction of condominiums and business buildings last year. The hardest affected were buyers, who are mostly, Overseas Filipino Workers. They have already paid for their units in advance but were dismayed to find out the construction has stopped. This issue between concerned developers and buyers has yet to be solved.

The non-payment of the mortgage had caused an increase in the number of property foreclosures since last year. Some property owners sold their residential or condominium units to start their businesses. Real estate websites such as Lamudi showed 593 foreclosed properties up for sale in Quezon City.

If you are keen enough to check on the foreclosed list, you may discover a house at an insanely low price. A business-minded person will consider this an opportunity to try to dabble in buy and sell.

Resiliency

Ironically, some areas are depicting a different atmosphere despite the pandemic. In our neighborhood alone, several household owners are into repairing, beautifying their houses, building flower beds, and carports. The food business is likewise thriving in our area. One would think it’s a “usual” market day if not for the facemask-wearing customers queuing for their orders. Resiliency perhaps is one of the “good things†these uncertain times have given us.

Carry on

Covid19 has affected everyone but, life continues to move forward. A year after the lockdown, we have yet to see the light at the end of the tunnel. Perhaps, we can safely move when the (Covid19) vaccine rollout reaches its intended beneficiaries. By then, we have achieved herd immunity.

Meantime, our dream house will have to wait until the pandemic is over and our youngest graduated from college. We will diligently work until we reach our goal. Â